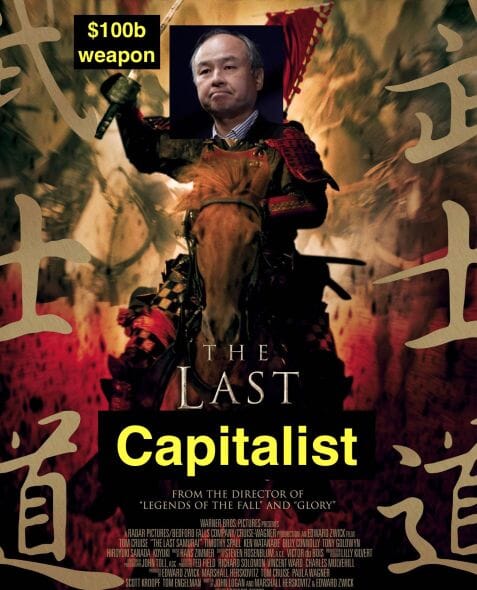

Masayoshi Son: The Last Capitalist

In a previous post , we mentioned that our model designated 2019 as the start of the crisis years which will be a general economic downturn culminating as a global stagflation.

This period will lead to a change in mentality, specifically with the capitalist system, which is really just the old mercantile system in a perfected form. The main difference is that Capitalism ‘arbitrages’ equity while mercantilism ‘arbitrages’ commodities.

First, Some History..

The mercantile system was created when paper money and paper instruments were invented by the Dutch in the 17th century. The Dutch got the idea from the moneylending Jews.

According to Montesquieu, it began in the 14th century, notably in 1394 when the French kings drove the Jews out of France but kept the wealth of the Jews inside of France.

- The Jews moved to Milan and invented cheques (letters of exchange) which they gave to foreign businessmen

- Those businessmen then claimed (or ‘encashed’) that Jewish wealth stuck in France in order to get around French laws and continue their own business.

Milan is close to Venice which traded with Asia through Constantinople.

When Constantinople fell in 1453 to the Muslims, the Venetians (and the Jews) moved to Spain and Portugal which were looking for an ocean route to Asia.

- The Jews were then expelled from Spain and Portugal notably in 1497 and 1540.

Some moved to Amsterdam which seemed to be the only major European country that allowed Jews (probably in the same way that nowadays they allow drugs and prostitution which are banned in other European countries).

- From Amsterdam, they spread their financial paper inventions.

- Such inventions probably influenced the first stock certificates issued by the Dutch East India Company which created the first commercial corporation in 1602 (In contrast, the British East India company started as a private regulated company).

Those value-carrying papers now manifest as:

- the fiat dollars of the United States and

- the term sheets and stock certificates of corporations

Capitalists then and now use these papers to control the work of people to execute their grand plans.

In the 17th century, those grand plans were the monopoly of the commodities trade and grabbing land from natives, called colonialism.

In the 21st century, it manifests as:

- the ownership of too-big-to-fail global companies which monopolize the buying and selling of goods and services

- the privatization of utilities, which force people to pay more for electricity, water, and telecoms while giving a guaranteed profits to investors

A Shallow Vision1

Masayoshi Son is Japan’s richest man and is the founder of the venture capital Vision Fund.

His fund tries to outdo all other venture capitalists by buying tech companies that can go global and disrupt all the other companies. To do this, he got money from very rich people, such as the King of Saudi Arabia, and used it to buy disruptive companies such as Grab, Uber, WeWork, Flipkart, and NVIDIA.

The whole idea is for those companies to disrupt the old industry-leaders and then become corporate monopolies, all through their tech advantage.

In lingo of Classical Economics, the liquid-money invested in them will then solidify into an asset-treasure, as stock prices. This will then be cemented by an IPO (initial public offering). That’s why the ultimate goal is for those investees to have an IPO.

These are the same notions that mercantile companies had. The British East India company, for example, created the first too-big-to-fail company to monopolize international trade* by allowing anyone to buy its stocks.

In addition, such an idea is ignorant of the fact that wealth is based on total human productivity which is limited by nature. Each human:

- only has 24 hours in a day

- can run at a certain range of speed

- can eat only a certain amount of food

- can only do work for a certain number of hours, etc.

But the human’s metaphysical desire for wealth however is unlimited. This difference between the limited and unlimited causes problems as crashes, systemic failures, etc.

The problem is that the larger a corporation gets, the more difficult it is to micromanage its daily tasks. This leads to micro-losses and inefficiencies which can snowball into large ones.

The directors of such companies are the managers of other people’s money. They cannot be expected to watch over it with the same vigilance as the partners in a private co-partnery. They are like the stewards of a rich man. They think that attending to small matters are not for their master’s honour. They very easily exempt themselves from attending to such matters. Negligence and profusion, must always prevail, more or less, in the management of the affairs of such a company. Simple Wealth Of Nations, Book 5

Adam Smith

Update 2019

Supereconomics Favors Small Businesses Working Together as a Large Entity

Our system primarily empowers micro and small businesses, allowing a natural micromanagement. Large impact can be done by such small enterprises through collaboration and cooperation.

-

The advent of ‘deep learning’ in artificial inteligence (AI) allowed many tech people, us included, to have ideas on the next big thing. The problem is that outsiders to AI think that AI is some tool that can be used instantly. In reality, it needs a lot of data which takes a lot of work and time collect, clean, and process. ↩︎