Law of Supply and Demand Fallacy

Update April 2021

Adam Smith’s Supply and Demand Curves (below) are the foundation our proposed science called Supereconomics which is based on Classical Economics. It can be applied to any problem in economics in order to provide common sense answers.

For example, the question below appears in Principles of Microeconomics by Mankiw, which teaches the unsustainable paradigm of Neoclassical Economics:

Question

The equilibrium price of coffee mugs rose sharply last month, but the equilibrium quantity was the same as ever. Which explanations could be right? Explain your logic.

Re-phrased Question

The market price of coffee mugs rose sharply last month, but the quantity supplied was the same as ever. What is the explanation?

This re-phrased question does not impose ’equilibrium,’ since it is a mercantile sophistry or a not-so-obvious-lie. We then apply Socrates’ Dialectical method in order to chase down the cause of its hypothesis.

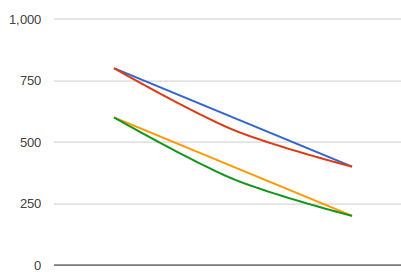

| _ | Economist | Supereconomist |

|---|---|---|

| Chart |  |

|

| Short Answer | The supply for coffee mugs was “perfectly inelastic” | The price of the coffee mugs during the previous month was an introductory price. The price afterwards is the natural price (a concept that is not present in economics) |

| Long Answer | There is a single supplier of coffee mugs. People have no choice but to buy from it at whatever price it wants, so the demand curve shifted to the right. Demand increased but supply was totally inelastic. | There are many suppliers of coffee mugs. A new kind of mug proved to be a hit among consumers, so the supply curve for it shifted upwards*. Based on the information in the question, assuming it is a realistic scenario (why would students be taught unrealistic scenarios?), we can deduce that the previous price was an introductory price, lower than usual, in order to entice buyers. So 4 mugs were sold at $3 each. The price was raised the next month as demand rose. Thus, 4 new mugs could be sold at $6 each, with a $3 rise in price. Production was not increased because the raw material was limited. *We don’t say that it shifted to the right just as we don’t say that today’s price is ‘more rightwards’ than last year’s. We always say that it’s higher or lower and never ‘righter’ nor ’lefter’. |

| Conclusion | Fallacy: There is only one coffee mug supplier or Coffee mugs are so essential to society that people won’t mind paying increasingly high prices for it | Relative Truth: No coffee mug, nor any product, could ever be worth an infinite value as to be a “perfectly inelastic” good. |

An established lie, taught in schools, creating a fake economic world that crashes often

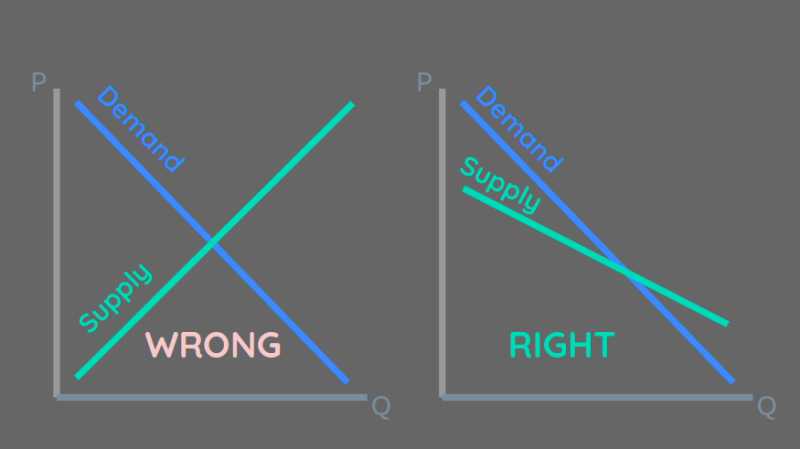

The marginalist elastic and inelastic supply curves are an example of sophistry. This is because supply curves ultimately have a downward slope, responding to the downward demand curve. We have called this the Consumption Motive , which is the opposite of Says Law .

In other words, businesses produce to meet the demands of society. In Economics however, the demands of society are manipulated to increase the produce and sales of businesses. This is because profits, and consequently utility and pleasure, come with sales. And so infinitely high prices are possible.

Thus, in the problem, people somehow are willing or made willing to buy the same coffee mug at a much higher price. In the real world, this can only happen if:

Scenario 1: There was only one coffee mug supplier in the whole society

That supplier merely needs to advertise its mugs to increase demand or ‘shift the demand curve to the right’. It can then steadily raise its prices as demand increases fearing no loss in demand. The economist’s answer leads to this.

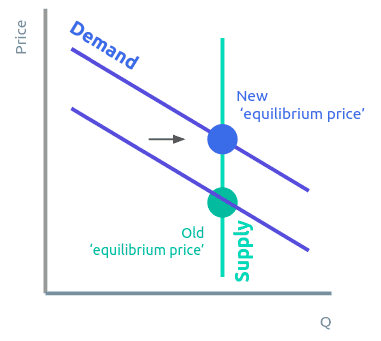

Scenario 2: There was an increased demand for that kind of coffee mug

An example is a special event for that month.

Adam Smith gives an example as a public mourning that raises the demand for black cloth. The same thing happens for flowers during Valentine’s day.

But in such cases, production is increased. But the question says production was not increased. It means the event was sudden or temporary, like rain creating a sudden demand for umbrellas on the street.

Even if this were the case, competition would prevent prices from rising arbitrarily unless there was only one umbrella supplier, which leads to the first scenario.

More realistically, the event called specifically for that kind of mug, which leads to the next scenario.

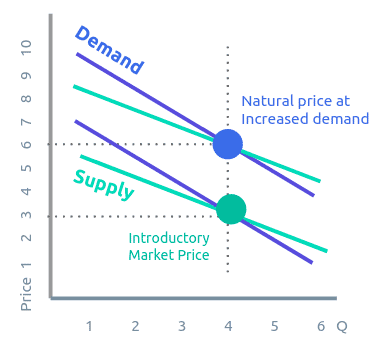

Scenario 3: That kind of coffee mug suddenly became so popular, for example through social media.

It was a new kind of mug based on a limited material.

It was first sold at an introductory price to test the market. Once demand was established, the mug-makers competed* for that limited material. This then raised the cost without increasing the number of mugs produced collectively.

This increased cost then increased its natural price. Unlike the economist’s answer, the price of the mugs in this case cannot be raised to infinite heights. The Supereconomist’s answer leads to this.

*In Economics, the knowhow to make the special mugs would be monopolized by a single supplier. In Supereconomics, on the other hand, the basic intellectual property is made available to allow others to make the product and quench all demand as fast as possible. This is most commonly seen in open-source software which has sped up the development of software technology, leading to very useful apps and online services.

Update July 2021

Update April 2021

Conclusion

In a free society, a product can never be “perfectly inelastic*”. Even if oil prices, for example, were raised to exorbitant prices, society will switch to coal, LPG, firewood, electric cars, public transport, bicycles, etc. through their own effort.

*Samuelson (and Mankiw) correctly assigns elasticity to Supply, while Case and Fair assigns it to Demand. Both assign ceteris paribus or a non-changing universe which is a very obvious fallacy

Even if a terminal cancer patient was given a chance to buy a life-saving drug in exchange for all his life’s present and future money as to make him a slave, he will likely not do the trade.

This is why economic slavery* is a real phenomenon in Economics through a system of inflation and debt (US fiscal cliff, Latin American debt crisis, Greek debt crisis, etc.)

*We define slavery as a regular state of control of another’s actions that produces perpetual subordination. We replace the jargon ’elastic’ and ‘inelastic’ with easy-to-understand words: ‘price-sensitive’ and ‘price-insensitive’.

Update October 2016

We found that Smith did mention that a commodity can be ‘perfectly inelastic’ if it matches the following conditions:

The first kind is the rude produce which human industry cannot multiply at all. Examples are: most rare birds and fishes, etc. Nature produces them only in certain quantities. They are very perishable.. Their demand increases with the increase in wealth and luxury. Their supply cannot increase beyond this increase of the demand. Their quantity remains the same while the competition to purchase continually increases. Their price may rise to any unlimited height.

Adam Smith

Book 1, Chap 11, Digression

However, the purchase of such endangered species is nowadays illegal just as slavery is illegal. Thus, it is still consistent with the earlier conclusion.

Updated question: The market price of Rhino horns rose in Vietnam sharply last month, but the quantity supplied was the same as ever. What is the explanation?

Supereconomist Answer:

- There was a sudden demand for rhino horns because of a rumor that it could cure cancer. Since rhinos are endangered, the production of their horns could not be increased. The demand raised the penalties imposed by the law, leading to higher prices for the smugglers who must offset the higher risk. Unlike the economist’s vertical supply line, the supply line will still be downward sloping, to match Smith’s maxim:

The natural price is the central price, to which the prices of all commodities are continually gravitating. Different accidents may sometimes keep them suspended a good deal above it.. But.. they are constantly tending towards it

Adam Smith