How to fix Japan: Why Abenomics and Keynesian Economics Failed

Table of Contents

| Current Cycle | Years per Day | Current Week | Current Month | Current Year |

|---|---|---|---|---|

| ? | ? | ? | ? | ? |

Japan has been suffering from chronic deflation since 1991 after the bursting of their asset price bubble.

This is similar in pattern to the secular stagnation in the US after the 2008 Financial Crisis. Both problems persist because they have been given the wrong solutions in the form of “quantitative easing” (QE) in the US, and “Abenomics” in Japan.

What is Abenomics?

Abenomics is a set of economic policies organized into 3 arrows:

1. Aggressive Monetary Policy

This pumps money into the private sector (microeconomy) so that businesses will employ people. This does not always work since microeconomics only uses labor if there is something profitable to employ that labor on.

An advanced economy will have so much competition and so many products. These reduce margins and discourage further investment.

As such, this situation merely keeps the money stuck in money markets and even makes it go overseas.

An easy proof is the Vision Fund of Softbank which invests in non-Japanese companies like WeWork and Uber, and the huge overseas investments by Japanese banks before and after the pandemic

In a country fully peopled.. the competition for employment would necessarily be so great as to reduce the wages of labour.. In a country fully stocked in proportion to all the business it had to transact.. the competition.. would everywhere be as great, and consequently the ordinary profit as low as possible

Adam Smith

2. Fiscal Stimulus

The profit maximization doctrine of microeconomics prevents businesses from hiring people even when money is available (since that money might not return with profits).

Keynes patched this problem by letting the government do the hiring. This creates a “multiplier effect” from the public sector which is similar to, but smaller than, a multiplier effect from the private sector. The government can do this because it can charge taxes to get back the value that it spent.

However, this method:

- raises public debt

- increases the risk of credit downgrade

- transfers the present burden to future generations who will be born with so many taxes to pay.

These will manifest as inflated prices and deflated real wages which prevent them from enjoying the life that the previous generation had.

For example, the previous generation never had to deal with supertyphoons, pandemics, and the permanently hot weather that they unknowingly created for the current generation. Rather, they knew about it but just didn’t care.

The ruinous practice of perpetual funding puts off the liberation of the public revenue from a fixed period to an indefinite period, never likely to come. However, it raises more money than the old practice of anticipation. When men became familiar with funding, it became universally preferred to anticipation during great state exigencies. Relieving the present exigency is always the object of government. The future liberation of the public revenue they leave to the care of posterity.

Adam Smith

The Wealth of Nations Simplified, Book 5

3. Structural Reforms

To support the 2 arrows, the Japanese government had planned additional policies such as:

- signing new trade deals

- raising taxes

- encouraging women in labour

- improving corporate governance and medical care

- allowing more foreign immigrants

However, these were not given as much focus as the first two arrows, leading to their incomplete implementation and subsequent failure.

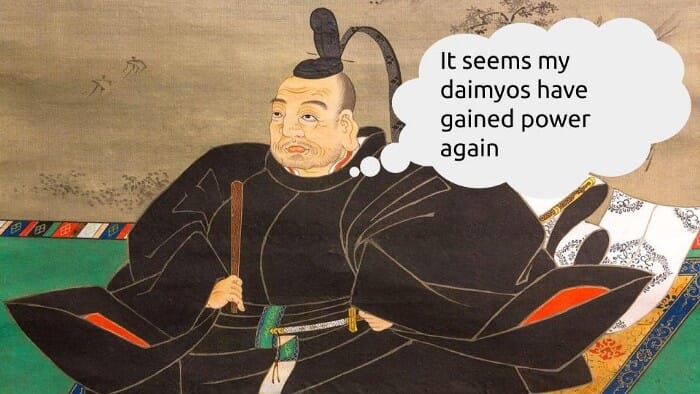

The failure of structural reforms is a sign that the influence of corporate Japan is still very strong. Using social cycle theory, we can make analogies between ancient and modern Japan:

- Japan Inc and employers are the modern daimyos

- The Prime Minister is a modern shogun who must work with his daimyos

- Japanese employees are modern samurais who must work overtime for their daimyos and pay sales taxes to the shogun. Karoshi (death by overwork) is a modern variant of seppuku (ritual suicide), with the sense of honor operating from the back of their minds in both cases. This is not the case in most other countries.

Sir Robert Walpole tried to establish an excise scheme on wine and tobacco similar to my proposal. The bill with those two commodities was then brought into Parliament. It was supposed to be an introduction of a more extensive scheme of the same kind. Faction and smuggling merchants raised a violent and unjust clamour against that bill. The minister dropped it. None of his successors dared to resume the project from fear of exciting another clamour.

Adam Smith

The Simple Wealth of Nations Book 5

The Problem with Keynes

The dominance of the daimyos over the shogun leads to a solution that does not work on the problem, but rather helps the daimyos .

Politically, Japan needs a modern Tokugawa Iyeyasu to make structural reform a priority. Without such reform, Japan’s stagnation will only continue.

After a modern Tokugawa quells his daimyos*, the question then becomes: what policies should be implemented?

Superphysics Note

From the failure of Abenomics, it is obvious that the policy should not be Keynesian. From the prioritization of the arrows, you can see the dominance of money in making up the first 2 goals. The dominance of money is also present in Keynes’ General Theory.

In fact, the 3 arrows of Abenomics looks as though someone copy-pasted Keynes onto an economic policy plan:

- Arrow 1 is Book 4: The Inducement to Invest . This has the liquidity-preference and monetary expansion

- Arrow 2 is Book 3: The Propensity to Consume . This has government spending and the multiplier effect

- Arrow 3 is Book 5: Money-Wages and Prices . This has wage increase and structural reform

A Depression is not a Deflation

The problem is that Keynes’ work was tailored for a depression, but Japan’s problem is a deflation.

It’s like taking cough syrup to treat back pain. A depression is caused by the lack of circulation of money and that’s why Keynes wrote a lot about how to make money circulate again. We then pointed out that the lack of circulation in the 1930s was caused by profit maximization from the Marginal Revolution of the 1870’s.

A deflation is caused by a population that is ageing or declining. No matter how much money you throw at an old man, his productivity and consumption will never improve to be like that of a young man.

The best solution* is to get more young men into the economy .

Update 2025

Some Japanese have pointed out that Japanese cities like Tokyo are already overpopulated and cannot handle any more humans.

I reply that Japan’s population is declining and so the infusion of new population is the best solution.

What really is missing is the proper cultural indoctrination of the immigrant population. This can be done by positive cultural adoption.

The US, Canada, Australia, and Singapore avoid deflation by regularly getting new immigrants. But Japan has what I call a ‘Late Ming mentality’ of closing off foreign people and ideas, which leads to their current deflation problem. A recent example is Carlos Ghosn being closed off from Nissan.

The Solution/s

Instead of 3 arrows, Abenomics really only needed 1 arrow of mega-structural reform and should have focused its energies on that.

The policies of John Maynard Keynes solve problems by transferring it to others, such as to public debt, and are really just workarounds.

It is Adam Smith, a historian and moral philosopher, who is the expert in total reform. He would likely advocate that Japan, South Korea, and China-Taiwan (depending on political climate) create an East Asia free trade zone with free immigration similar to the EU. This is similar to how he advocated a fair union between England, Wales, Scotland, and Ireland.

An East Asia union would solve:

- Japan’s deflation

- China’s tech sector problem (or Taiwan’s security issues)

- South Korea’s grievances against Japan

Supereconomics proposes a multilateral clearing system to go with this free trade zone to further unify the participating countries.

Generally, Smith’s policies would be somewhere between Singapore and China where the government has strong control in specific areas, but allows freedom in the rest. It is based on morality, specifically as fellow-feeling.

In contrast, Keynes’ policies are based on animal spirits, which explains the current inequality where the 1% are the ‘fittest’ of our species. Those spirits enshrine selfish-interest as liberalism, libertarianism, American conservatism, and laissez faire.

Lastly, cultural reforms need to be undertaken to harmonize Japan with the rest of the world. For starters, it can classify kanji as an art form instead of being used in everyday communication. This will let its language be more easily learned by foreigners.