How to Solve Inequality

Table of Contents

According to Socrates, inequality takes root most commonly when a society transitions from intellectual rule to an oligarchy:

An Oligarchic State is not one, but two States, the one of poor, the other of rich men. They are living on the same spot and always conspiring against one another. Their fondness for money makes them unwilling to pay taxes. Under such a constitution, the same persons have too many callings. They are husbandmen, tradesmen, warriors, all in one. It does not look well. The greatest evil of oligarchy is that it creates the extremes of great wealth and utter poverty.

Socrates

In the US, this began with Reaganomics and had its peak in the boom of the late 1990’s and collapsed with the 2008 Financial Crisis.

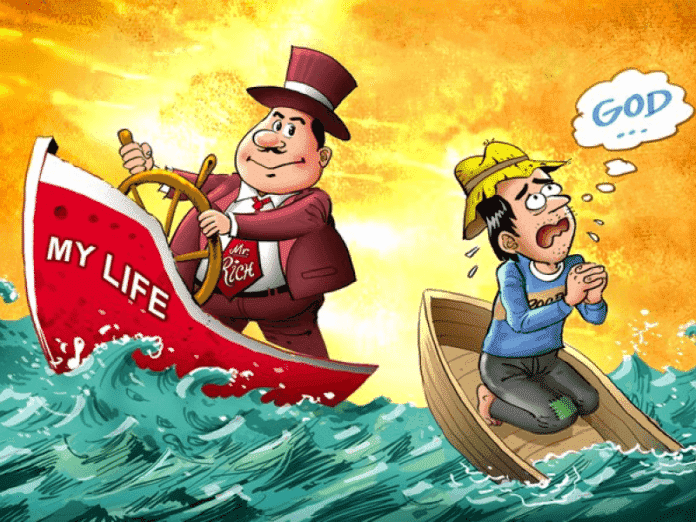

The wealth gap rises because the upper classes earn by profits while the middle and lower classes often earn by wages.

- Profits are based on a percentage of the selling price or gross revenue, such as 5% commission or 10% margin.

- Wages are a fixed number like $10/hour or $1,000/month

Suppliers can raise their prices bit by bit on a daily or weekly or monthly basis since they control the means of production. They only have to deal with the changes in:

- the market demand that affects sales volume

- the interest rates that affect the supply of money running the business

But wages cannot rise in the same way since the employees are not in control of the market or the finances of their own company.

When prices rise, the owners of the company still get a high revenue by jacking up selling prices, but their employees get lower revenue as it is eaten up by that very inflation.

Also, employees must pay income taxes that eat up their revenue, but company owners can do creative accounting (tax avoidance) to prevent this from eating their profits.

In time, the differences in revenue lead to a wealth gap.

The Solution to Inequality

The root cause of inequality is the difference in the nature of rent, wages, and profits.

Monetary solutions to inequality, such as universal basic income and quantitative easing, can never solve it because it does not address the fundamental differences between those 3 revenues.

The proper solution is fiscal and structural reform.

Tax Reform

Taxing gains can reduce profits to match it better with wages. Property taxes can equalize wealth as well.

Nowadays, taxes are generally percentage-based (eg 10% VAT, 35% Corporate Tax) just like profits.

The poll-tax was a fixed-number taxation system which has been abolished.

This is why Piketty advocates a global wealth tax .

However, a tax is a negative action which can be stifle growth. To address this, we propose social points as a positive action against inequality .

Structural Reform

While taxation is an active solution to inequality, structural reform is a passive solution.

Its main principle is competition to dislodge concentrations of wealth that tend to block the flow.

In her present condition, Great Britain resembles an unwholesome body with some overgrown vital parts.

- Her body is liable to many dangerous disorders which affect unproportioned bodies.

- Her blood vessel was artificially swelled beyond natural by the industry and commerce forced to circulate in it.

A small stop in that great blood-vessel will very likely bring the most dangerous disorders on the whole political body. The expectation of a rupture with the colonies has struck the British with more terror than the Spanish armada or a French invasion.

Adam Smith

The Wealth of Nations, Book 4, Chapter 7

Since profits are from the merchant or trading class, then the reform breaks up monopolies through competition in business and finance.

Business competition: Exorcism and Guardian Angels

The usual strategy of monopolists is to invest heavily in a corporation to reduce costs and drive its competitors out of the market.

After the competitors are gone, the corporation gradually raises its prices, higher than the normal rate, in order to recover its investments with business profits.

We call this the “Evil Angel” strategy.

To prevent this, the government has 2 options:

- Anti-trust legislation

This prevents corporations from merging and gaining a monopoly. This is the exorcism of the Evil Angels.

- Sovereign wealth funds and state-owned corporations

This makes the government invest, such as into telecoms and utilities, in order to make them affordable to all. This is the “Guardian Angel” that prevents “Evil Angels” from implementing their evil.

Circulatory Competition: Rival Religions

Both exorcisms and guardian angels use the same religion of money. In order to comprehensively prevent blockages in the flow of resources, we propose a rival religion based on barter-credits.

This uses grain-based valuation instead of money. This empowers farmers who control the supply of grain, just as the financial system empowers bankers who control the money supply.

When investors pool their money into money markets to increase paper wealth instead of actual wealth, the barter-credit system will naturally be more active, with people bartering with each other on credit to meet their own needs.

Alternative to Universal Basic Income: Minimum Needs

Instead of Universal Basic Income, the excess and unsold products from stores, factories, and farms are given to the poor on barter-credit.

The poor can then pay for these through their labor either to those stores, factories, and farms, or to the government which will then give a tax credit to those stores, factories, and farms.

This reduces waste, while creating employment, and is called Minimum Needs.

So Minimum Needs is the basic comprehensive solution to inequality that can be implemented on the community level, even within a family or a group of friends to reduce the inequality between children or friendds.

Its main requirement is fellow-feeling.

There will still be a loss to society if the poor do not want to work and just want to get freebies. In such a case, such people do not have fellow feeling, and so they will be ejected from the barter-credit system and put at the mercy of the money-system.