How to Restore the Gold Standard through Clearing Funds

Table of Contents

Our proposed Multilateral Clearing system , derived from EF Schumacher and Adam Smith, can prevent currency attack and commodity speculation by:

- making forward contracts not transferrable

- not allowing private currency trading

The job of providing liquidity and transferring working capital to the producers and exporters will be done instead by “clearing funds”.

But how will the system work for overseas investments?

Bank Gold

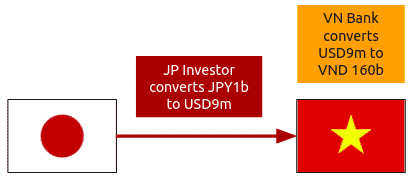

If a Japanese investor wants to invest his JPY 1b in Vietnam using the current financial system, he will convert it to USD which the Vietnamese banks will convert into VND. This would make the investment subject to USD fluctuation from speculators and currency attack. This also requires two conversions which will increase its cost.

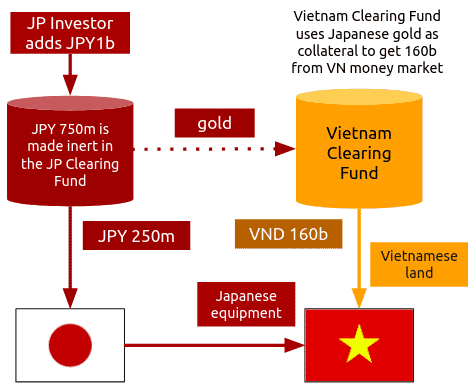

To solve this, our clearing system will let the investor deposit his JPY 1b into the Japanese clearing fund. Let us assume that he splits his budget into four parts:

| Target Currency | Type | Purpose | Initial Value | Target Value |

|---|---|---|---|---|

| VND | Vietnamese wages | Working Capital | 250m JPY | 160b VND |

| VND | Local materials | Working Capital | 250m JPY | 160b VND |

| VND | Vietnamese land and construction | Fixed Capital | 250m JPY | 160b VND |

| JPY | Japanese equipment | Fixed Capital | 250m JPY | 250m JPY |

How can the JPY 750m be converted to VND 160b without swapping currencies?

This can be done in the following steps:

- The JPY 750m will be deposited into the Japanese Clearing Fund as security to borrow Japanese central bank gold at the pool rate.

This assumes that the central banks know the actual money supply and have pegged their rates accordingly. This central bank gold is not a representation of gold but really a representation of grains.

- The gold will be transferred to the account of the Vietnamese central bank

It will serve as central bank guarantee to invite the VND money market* to deposit 160b VND into the Vietnamese Clearing Fund under the investor’s name

The investor can then use the VND to rent government land, materials, and pay wages

*The main attraction will be the fact that their investment is guaranteed by the entire pool and not subject to inflation

This sends real value from Japan to Vietnam through the transfer of central bank gold.

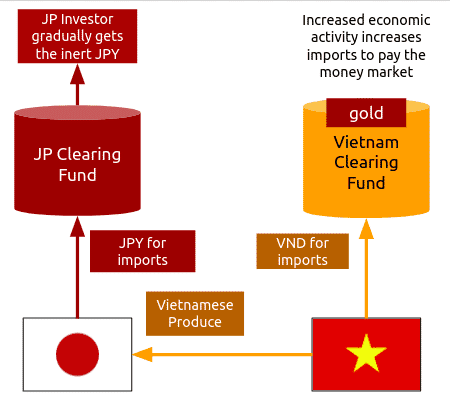

The return trip of that gold is as follows:

-

The Vietnamese investee will then export the produce, most of which will be bought by Japanese importers who will pay into the Japanese Clearing Fund

-

This will trigger the inert JPY 750m to return to the investor over time

The VND owed to the VND money market will also return to the Vietnamese investors.

- After the 750m JPY and 160b VND cash have been recovered, the gold is tranferred is back to the Japanese central bank

If the investment fails, then other foreign investors can add more gold to overhaul it to make it work.

Alternately, the investment can be wound down and the inert JPY can be used to export Japanese products to Vietnamese investors to satisfy their claim with even the possibility of material gain, despite a monetary loss.

This clearing system is different from the current commercial system as it creates a win-win situation through the cooperation of the central banks, investors, producers, exporters, and importers.

The commercial system, on the other hand, fosters no such cooperation. This is why banks with failed investments get stuck with non-performing loans which then cause financial crises.