The 3 Problems with Money

People have loved money ever since it was invented. The philosophers David Hume and Socrates, on the other hand, were not so keen on money because of its drawbacks, which we distill into three:

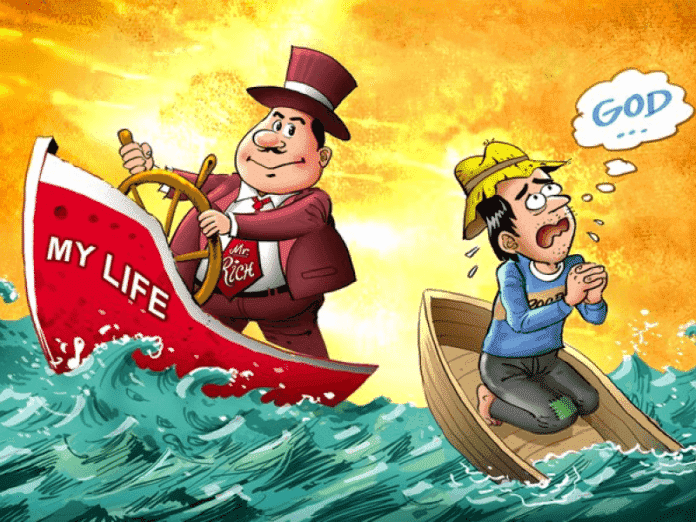

1. Money builds ego

Having a lot of money gives theego power over other egos, giving a feeling of superiority to the monied-ego, leading to arbitrary actions which encroaches on other egos, creatinginjusticeand eventually,evil.

A dirt-poor evil bum can hurt a few people, but an ultra rich evil man can hurt so many.

We solve this by using the effort theory of value, facilitated bysocial contractsin order to prevent injustice and the growth of evil. This will prevent democracies from degenerating into tyranny and aristocracies from slipping into oligrachy, in Socrates-speak.

None of the most furious excesses of love and ambition are in any respect to be compared to the extremes of avarice.

David Hume

2. Money destroys information in every exchange

If you work for 1 hour in exchange for $10, then your work-information generated in that hour will be overwritten by the $10-money-information, just as a particle is bumped off by another particle. You don’t remember most of what you did in every day of the first month of your first job, but you remember your first salary amount very well.

In contrast, a productivity-for-productivity system would retain all the information about that productivity, allowing precision in productivity-allocation.

Why hire a plumber and a carpenter to fix your kitchen sink and dinner table, when you can just hire one guy that has experience in both?

The lack of money can never injure any state within itself because people and commodities are the real strength of any community.

David Hume

3. Money only works for the here and now

Prices can only be assigned by the mind relative to the current moment and place. This is why asset prices fluctuate far more than wages or most commodities that circulate regularly.

Money doesn’t work for things that have a not-so-obvious-value (wave-value) such as:

- the unseen labour being done by a rainforest in cleaning the air

- the health benefits of eating a vegetable

- the inventions that will only have impact after long and costly research

Economics has no way to accurately put a price on the future effects of such things, but Superphysics has, through relativistic effort-valuation and resource credits.

Deprive a man of all business and serious occupation, he runs restless from one amusement to another. He feels such a great weight and oppression from idleness and forgets the future ruin of his immoderate expences.

David Hume

The key is not in having a lot of money or having no money, but in having the right amount of money:

Under the influence either of poverty or of wealth, workers can degenerate. Here, then, is a discovery of new evils of wealth and poverty, against which the guardians will have to watch, or they will creep into the city unobserved. Wealth is the parent of luxury and indolence. Poverty is the parent of meanness and viciousness. Both are parents of discontent. The Simple Republic, Book 2

Socrates

Every unnecessary accumulation of money is a dead stock which could be employed in enriching the nation by foreign commerce. Lectures On Jurisprudence

Adam Smith