Three Modes of Exchange or Tools of Trade

Chapter 1 explained the 2 stores of value:

- Commodity-based

- Faith-based

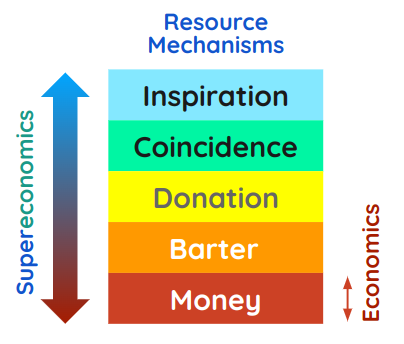

Value transfers between people, or is created, in 5 ways, which we call the 5 resource mechanisms which match the 5 layers of reality:

| Mechanmism | Layer | Mode of Value |

|---|---|---|

| 1 | Aether | Inspiration (Useful ideas or energy that come from nowhere) |

| 2 | Spacetime | Luck (being at the right place at the right time) |

| 3 | Radiant | Donation, Gift, or Investments that Lose Value |

| 4 | Convertible | Barter or Investments that Earn Value |

| 5 | Material | Money or Currency |

These come in a ratio to make up 100% value for society.

For example, the invention of an car or automobile might require:

- Inspiration (Mechanism or Mode 1) for an idea of inventing a car

- Bumping into an investor (Mechanism 2) while going out to lunch

- Him giving a grant (Mechanism 3) for you to make a prototype, and then him investing (Mode 4) money (Mode 5) to build a shop to produce a car

All these modes lead to the production of a car for society.

However, we are concerned with the physical means of exchange, and not the metaphysical ones. This is why we will focus on the 3 modes of Exchange:

- Money

- Barter

- Donation in money or kind

When you donate, you get nothing back other than the abstract gratitude of the person you donated to. Therefore, it is an exchange of something physical for something abstract or aethereal.

Money and donations are already known in Economics. But barter has been forgotten after money became prevalent. This is why we need to address the common misconceptions about barter later. But first we will discuss the problems with money.