How Profit Maximization Led to the Great Depression

Table of Contents

The industrial revolution in Europe in the 19th century allowed mass production which then allowed huge profits for those who invested in it.

This prevalence of profits led to concept of profit maximization, taught in universities through the Marginal Revolution of the 1870’s. Previously, Classical Economics warned against the doctrine of profit maximization which was closely associated with destructive system of Mercantilism.

European colonization was largely fueled by the Mercantile idea of buying cheap commodities from the colonies to be sold at a high price in Europe. Too-big-to-fail mercantile corporations, such as the East India Company, were capitalized exactly for this purpose, to enslave the natives for the sake of those commodities.

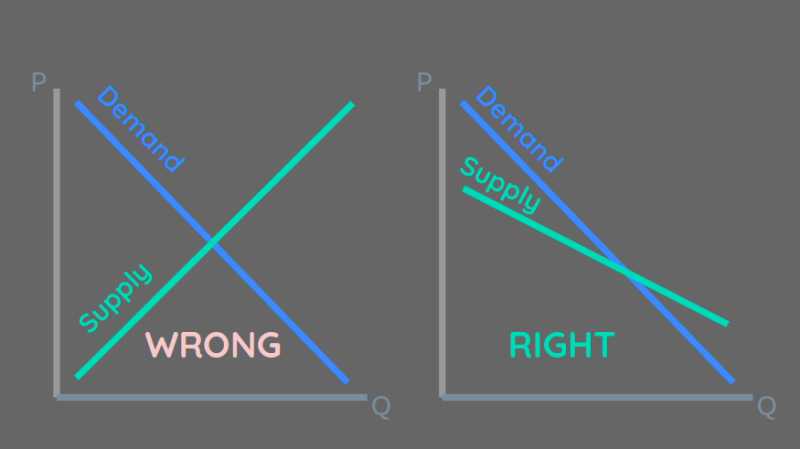

The Marginal Revolution began the departure from Classical Economics and into Neoclassical Economics in the early 20th century. Instead of emphasizing productivity, as done by Classical Economics, the Neoclassical system emphasized profits.

The problem is that profits is an accounting concept, done on paper. It can be achieved by proper means such as increasing production efficiency, or by improper means such as through speculation and scams.

Productivity, on the other hand, is a real concept. It can be measured by actual physical measurements such as counting the things produced or the kilos harvested.

The Neoclassical system therefore increased speculation. This is why ‘panics’ became common towards the end of the 19th century and increased into ‘crashes’ by the 1910s and 1920s.

Why Didn’t Speculation Pay Off?

People speculate in order to maximize profits. They invest or gamble with a small amount of money, hoping it to become a large amount in a short time.

The increased investments spur the economy, usually creatomg am economic boom.

A hot economy would then find itself having low profits naturally. If everyone who needs iPhones already has them then there is no more need to buy iPhones and no more need to sell them.

A country fully stocked in all the trades possible would have great competition everywhere. It would reduce ordinary profits to the minimum.

Adam Smith

The Wealth of Nations Book 1, Chapter 5

So the economy naturally produces low profits, but the educational system teaches people to aim for high profits. This contradiction leads to speculative investments that do not pay off, leading to a crash.

According to Classical Economics, a crash would reduce prices. This would then prompt people to buy and invest again, and get the economy running as before.

So why was there no recovery after the 1929 crash? Why did government have to step in and spend taxpayer money to resuscitate the economy?

The main culprit was the idea of profit maximization.

In the Classical System, people are taught to spend and invest and get returns, even if they are small or break-even, as long as it is not a loss.

But in the Neoclassical System, people are taught to spend and invest only for maximized returns. This new imposition prevented the spending that would have regrown the economy in the 1930s, leading to the Great Depression.

This transferred the burden of reviving the economy to the government which, by nature, is not-for-profit.

This led to the concept of Keynesian macroeconomics

The Wrong Solutions of Keynes

The 2 main solutions of the British economist John Maynard Keynes to the Great Depression were:

- deficit spending

- open-market operations

Deficit Spending

Deficit spending is when the government gets in debt in order to prop up employment or the economy. We can say that this is a fiscal solution. This now manifests as big public works projects.

It follows that if the people choose to consume, then the multiplier k is 10, and the total employment caused by increased public works, for example, will be 10 times the primary employment provided by the public works themselves

John-Maynard-Keynes

The General Theory Simplified, Chapter 10

A big decline in income due to a decline in the level of employment may even cause consumption to exceed income. In the case of the Government, it will run into a budget deficit by providing unemployment relief by borrowing money.

John-Maynard-Keynes

The General Theory Simplified, Chapter 8

Open-market operations

Open-market operations is when the central bank buys or sells government bonds in order to control the money supply. We can say that this is a monetary solution. This now manifests as quantitative easing.

The aggregate demand for money to satisfy the speculative-motive continually responds to changes in the rate of interest, as a curve. These changes are in the changing prices of bonds and debts of various maturities. This is why “open market operations” are done…

Open-market operations may influence the interest rate since they may change the volume of money and change expectations on the future policy of the Central Bank or the Government.

John-Maynard-Keynes

The General Theory Simplified, Chapter 15

Instead of going against profit maximization, Keynes actually embraced it and transferred the burden of growing the economy to the government. This makes the economy totally dependent on the whims of government policy, instead of being based on the feelings and decisions of the people.

- Deficit spending has led to government shutdowns as the stoppage of some government programs or offices.

- Open-market operations and monetary easing has led to moral hazard where speculative banks were bailed out and ‘animal spirits’ are fed.

- Moreover, the pumping of money through the banking system and money markets has led to rising inequality, manifesting nowadays as underemployment and ‘bullshit jobs’.

The Supereconomics Solutions to the Great Depression

The Great Depression was caused by the scarcity of money which was, in turn, caused by profit maximization which hoarded that money.

This scarcity led to the failure of many businesses. This then led to massive unemployment which led to a decline in demand. These created a cycle of downturns that caused a lot of hunger and poverty.

Supereconomics would resolve the Great Depression with the following policies:

- Nationalize Key Corporations

The government would nationalize the major or critical banks and factories that were threatened by collapse.

The government would borrow from the wealthy by issuing bonds, which it will then use to recapitalize those enterprises. The competitors of those enterprises will then be awakened into action, at the prospect of them losing market share to the nationalized company. This will then restart employment which will drive demand anew.

After the nationalized companies have gone back to health, the government can then sell them in order to pay back the bondholders.

Unfortunately, because of the doctrine of laissez-faire pushed by Mercantilism from the 18th-19th centuries, policymakers are unable to think of this solution.

- Enable Barter Trade

Since the Depression is caused by the hoarding of money, barter trade via barter credits can recirculate the basic parts of the economy. The government can issue bonds to purchase food and basic goods for the people who will then promise to pay the government in kind, through their own goods or services.

This will restart the basic part of the economy.

- Find Export Markets

The government can find foreign economies (those without a recession) to sell local products to. This will bring in money which will restart the non-basic parts of the economy.