The Market Equilibrium Fallacy Part 2

Table of Contents

We combine both Supply and Demand curves to come up with a Supply and Demand model.

Samuelson’s Version

Samuelson justifies the unnatural supply curve with buying and selling through an auctioneer scenario. This is the same sophistical technique used by Jevons and Marshall, in their attempt to justify equilibrium.

Which level will the price actually go? And how much will then be produced and consumed?.. Let us proceed what an auctioneer would do, i.e. proceed by trial and error.

Paul Samuelson

This is obviously false because no one goes to a grocery store to outbid other shoppers for every potato or loaf of bread.

Neither do we make bids when we get drinks from a vending machine.

In reality, we as shoppers, have freedom to choose:

- where we do our groceries

- which vending machine to get our drinks

It is the groceries and vending machine companies that compete with other sellers for our attention.

From trial and error, Samuelson ends up with an equilibrium point where both curves intersect:

The equilibrium price, i.e. the only price that can last, is that at which amount willingly supplied and willingly demanded are equal. Competitive equilibrium must be at the intersection point of supply and demand curves.

Paul Samuelson

However, it is interesting to note what he says about what happens at low prices:

Can that price ($1 per bushel) persist? Again, obviously not-for a comparison of Columns (2) and (3) shows that consumption will exceed production at that price. Storehouses will begin to empty, disappointed demanders who can’t get wheat will tend to bid up the too-low price. This upward pressure on P is shown by Column (4)’s rising arrow.

Paul Samuelson

This is Samuelson’s second fallacy because:

- A product can only be sold cheaply if it is produced cheaply.

- It can only be produced cheaply through economies of scale.

- If it has economies of scale then there can be no shortage.

In fact, there are many cases of crops being overproduced and merely dumped. If wheat falls to $1, then it means that its production was plentiful, opposite of Samuelson’s assertion that storehouses will begin to empty.

The Mercantile Version

Like economist’s supply curve, the mercantilist’s supply curve also slopes upward.

If we send £100,000 in money to Amsterdam to buy Pepper then send it to Italy, it must yield £200,000, doubling the money. If we send the £100,000 to India to buy Pepper and sell it to Italy, we can earn £700,000 gross. But where the voyages are short & the supply plentiful, the profit will be far less. If our consumption of foreign goods stays the same and our exports increased, the overbalance must return as money or foreign goods from our re-exportation, and increase our revenue more.

Thomas Mun

[The forex dealer in Amsterdam who imports British coins] has the same effect as if a Dutch Merchant had carried away those coins, which he must do if Dutch goods are overbalanced which makes our money undervalued. And on the contary, when the forex dealer brings in Dutch coins into England, he does the same thing that the English Merchant does when our British commodities overbalance Dutch goods.

Thomas Mun

Similarly, the mercantilist advocates reducing supply to increase the selling price, and cutting costs to increase profits.

By replacing ’exports’ with ‘sales’, and ‘imports’ with ‘purchases’ or ‘costs’, we can see that the merchant does the same things that the manufacturer does. What the manufacturer calls ’equilibrium’ is called ‘balance’ by the merchant, while ‘profit maximization’ is ‘overbalance’ or trade surplus*.

Smith’s Version

Unlike Samuelson who takes the position of the seller, Smith takes the position of the buyers. This is why profit maximization* never enters Smith’s curves.

The natural price is the lowest price that a dealer can sell his goods.. The market price is the actual price at which any commodity is commonly sold. Market prices are regulated by the proportion between the quantity to be sold and the demand of buyers willing to pay the natural price.. When the commodities fall short of the effectual demand, the shortage will cause some of the buyers give more for those few commodities. This will create a competition among buyers which will raise the market price. When the amount sold exceeds the effectual demand, the excess will remain unsold. To dispose of it, it must be sold to those who are willing to pay less.

Adam Smith

*Instead of profit maximization as producer’s surplus, buyers are interested in bargains as consumer’s surplus

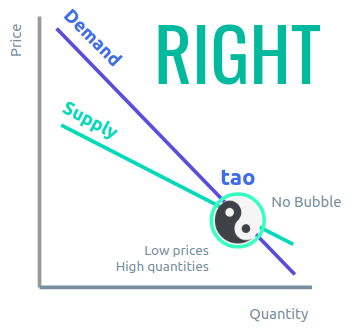

Unlike the curves of the manufacturer and merchant, Smith’s curves slope downwards to create low prices because it views economic activity as ultimately for the demanders or consumers, and not for the suppliers or sellers.

It is the Way of Heaven to reduce superabundance and to supplement deficiency. It is not so with the way of man. He takes away from those who have not enough to add to his own superabundance. Who can take his own superabundance and use it to serve all under heaven? Only he who is in possession of the Tao!

Lao Tzu

The Tao Te Ching Simplified, Part 16

An Inherent Contradiction Leading to Systemic Crises

As you can see in the chart above, the sweet spot of the natural supply and demand is on the lower right section, representing high quantities at low prices.

However, the profit maximization doctrine of Economics teaches that:

- supply must be reduced so that prices will rise

- competition should be stifled in order to preserve one’s monopoly position so that high profits can be guaranteed to the investors.

The resulting high prices and low supply then contradict the goal of economic growth, especially after bubbles and financial crises.

Economists try to save face by saying that perfect competition is needed for it to work. But they do not realize that their supply curve makes perfect competition impossible in the first place.

Because of this, ‘real equilibrium’ is never achieved despite the best efforts of economists and governments.

Worse is that the ecconomists and policymakers had no idea that their policies and theories were devised by the vested interests of traders, manufacturers, and financiers to benefit traders, manufacturers, and financiers.

Such people only want maximum wealth for themselves, not knowing of the problems that excessive wealth creates:

When a potter becomes rich he will not think of you as much as before. He will grow more indolent and careless, and become a worse potter. But, on the other hand, if he has no money, he cannot provide himself with tools, he will not work well, and he will not teach his sons or apprentices to work well. So under poverty or wealth, workers can degenerate. Here is a discovery of the new evils of wealth and poverty which the guardians will have to watch, or they will creep in unobserved. Wealth is the parent of luxury and indolence. Poverty is the parent of meanness and viciousness. Both are parents of discontent.

Socrates

The Republic by Plato Simplified, Book 4

The Solution: Natural Price Theory and Economic Democracy

Adam Smith specifically pointed to the selfish-interests of traders, manufacturers, and financiers as the origin of the concept of market equilibrium:

The interest of any dealer is opposite to the interest of the public. To widen the market and to narrow the competition is always the interest of dealers. To widen the market might be agreeable to the public. But to narrow the competition is always against the public interest. It enables the dealers to levy an absurd tax on their fellow-citizens, raising their profits unnaturally. Great precaution should be taken on any new commercial law proposed by this order. It should never be adopted until after long and careful examination with the most scrupulous and suspicious attention.

Adam Smith

The solution is a new paradigm that values all of society:

- the wage earners: workers, employees

- the profit earners: traders, manufacturers, financiers, farmers

- the rent earners: government, landlords, intellectual property holders, stockholders, asset owners

- the donation earners: religions, researchers, charities, NGOs, news companies, artists

By exposing the sophistical ideas such as equilibrium and profit maximization, we can say that Economics from the 1870’s is actually a corrupt science, and not merely a dismal one.

It descended directly from Mercantilism which caused so much suffering in the colonies in Asia, Africa, and the Americas, and is still creating suffering nowadays through inequality, high prices, college debt, high taxes, etc.

Rather than reform a system with a corrupt base, it would be better to create a new and proper one that is in line with the interests of society and human life.

This is why we introduce alternatives to every major economic concept as the foundation of Supereconomics:

- Natural Price Theory replaces Equilibrium Theory of Microeconomics

- The Effort Theory of Value replaces Profit Maximization

- Net Domestic Product replaces GDP of Macroeconomics

- Economic Balance replaces GDP growth