Alternatives to Money as Store of Value

Both Economics and Mercantilism use money as their store of value and tool of trade.

- Mercantilism was also called the Commercial system and now takes the form of E-commerce.

To buy anything online, you need a credit card or any electronic system.

Prior to commercialization, the universal method was barter. For example, the Mongols and the Inca were able to sustain their empires by bartering goods and services.

How The Commercial System Spread

According to Adam Smith, coined money began in the West with Servius Tullius.

In China, paper money began with the Song dynasty. The Yuan upgraded it to create the first central bank.

In Europe, metal money was reestablished by the Spanish who conquered Europe.

This political control allowed economic control through minted money.

This is why politics is prior to economics, and is why Supersociology, as morals, is prior to Supereconomics, as valuation.

The main difference between the economic system of China and Spain was that Spain had no central banking.

Instead it outsourced its banking to merchants, as mercantile companies which merely paid taxes to the King.

In contrast, the Yuan did commercial projects through its vassals, with the emperor having ultimate control.

Morality-based Imperial System Vs Money-based Commercial System

The Chinese and Indian imperial system had more power than the European kings because they had a more advanced moral philosophy.

The first ‘colonizers’ were the Indian Gupta dynasty which established the modern Sri Lankan, Thai, Cambodian, and Indonesian civilizations. These are similar to the Greek style of colonization which did not aim to strengthen the mother country.

In contrast, European colonization was done to strengthen Europe at the expense of the colonies. This was even true for the American colonies which were supposed to strengthen Britain.

Because of colonization, all countries adopted precious metals. This allowed the commercial money-only system to monopolize all buying and selling transactions.

The showdown between the commercial and the imperial systems manifested as the Opium Wars wherein the Chinese imperial system was defeated.

However, the commercial system also created problems:

- Inefficiency in running an economy

Before you can buy bread in the commercial system, you need to have money.

To have this money, you need to sell something that you have.

To sell something, you need to find a market. So to buy anything, humans need 3 steps: marketing, sales, financing

- High expense and unproductive labor in financing the economy or supporting money

The monopoly of money for exchange necessitates an expensive financial system supported by bankers, financiers, tellers, accountants, lawyers, etc.

This adds to the cost of the economy without adding any real value.

Adam Smith calls these ‘unproductive labor’ and is the most expensive part of the economy

- Lack of responsiveness, and slow progress

Since many steps are needed to procure money, there is a lag in responding to supply-and-demand opportunities.

This results in missed opportunities for addressing the needs of society, or for creating advanced technologies as many promising research projects remain unfunded.

A lot of deals fail because one party lacks money to complete the transaction.

- Arbitrariness and volatility

Money allows economic control which can have both good and bad effects.

- One one hand, it keeps some stability through a central bank as the wholesaler of money.

- However, this same control also creates volatility when that money is hoarded by retailers such as banks and financiers.

To solve these problems, Adam Smith suggested grains and precious metals as the store of value:

Labour.. is the only universal and the only standard by which we can compare the values of different commodities at all times and at all places. From century to century, corn is a better measure than silver, because, from century to century, equal quantities of corn will command the same quantity of labour more nearly than equal quantities of silver. From year to year, on the contrary, silver is a better measure than corn, because equal quantities of it will more nearly command the same quantity of labour.

Adam Smith

The Wealth of Nations Book 1 Chapter 5

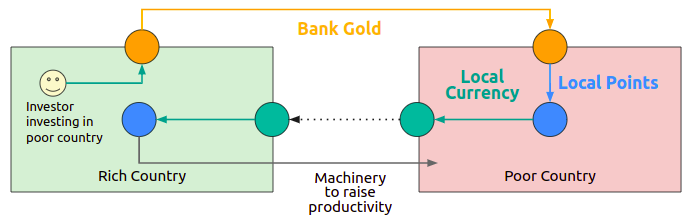

This is why Supereconomics uses points and “bank gold” to replace fiat currency*.

Points are pegged to grains and are used for local transactions. For example, in China, the points will be pegged to rice. In the US, it will be pegged to wheat.

Central bank gold will be used to transfer investments from one country to another.

This makes the International Monetary Fund unnecessary. This gold is a fixed ratio to the actual fiat that is circulating and is different from market gold. This then leads to a gold-backed currency that makes the arbitrary printing of money illegal.

Superphysics Note

Thus, a Supereconomic system will have 2 stores of value:

| Kind | Manifestation | Speed | Reach | Remarks |

|---|---|---|---|---|

| Grains | Local Points | Moderate | For local transactions of basic value | |

| Gold | Bank Gold and gold-backed local currencies | Slow | For foreign investments and circulation of non-basic value (wholesale money) |

Bank gold will only be used to circulate investments between countries and have nothing to do directly with commercial activity since bank gold is not legal tender (you can think of it as legal tender only between states). However, it will be the basis for gold-backed currencies which then will be used to circulate value.

Gold-backed currencies solve the fourth problem with money. However, it still suffers from Problems 1-3. This is where points come in.

Points are Pegged to Grains

To prevent the arbitrariness, we create a second store of value as points which are pegged to grains.

Only banks can create bank gold, but everyone can create grains through farming. The grains represent a person’s productivity, as judged by other people. Tihs is because everyone has an idea of how important rice or wheat is in their lives.

This solves Problems 1-3:

-

To buy bread without money, all you need is proof that you have productivity through your points balance

-

The recording of points can be done cheaply by pen and paper. The Inca used strings called quipu. We will use cloud-based databases and APIs served by the internet.

-

Letting the points be served through the internet allows real-time responsiveness

In Economics, you can buy bread or get a haircut only if you have money.

But in Supereconomics, you can do both by using money OR points.

This will allow a supereconomy to keep on moving even during a financial crisis.

During a crisism the supereconomy can switch to points for its essential transactions*.

- Points are for basics

- Gold-backed currencies are for non-basics

Are Grains Really Stable?

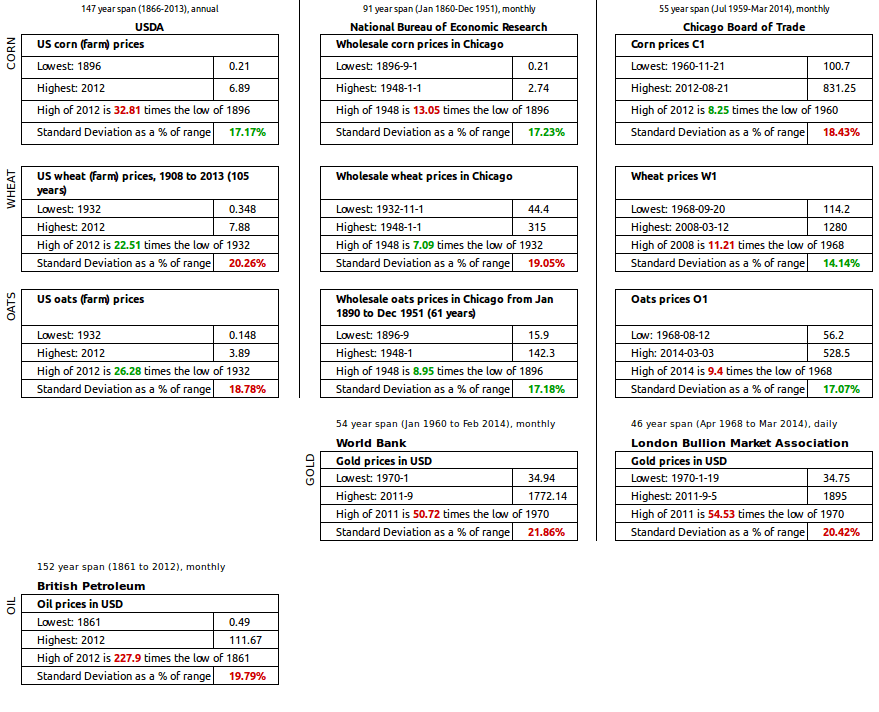

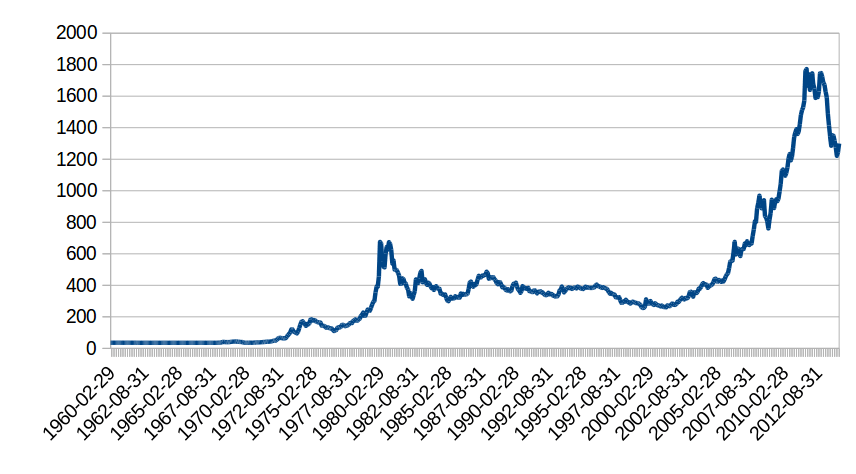

Adam Smith advocated wheat as the universal measure of long-term value because of its stability.

The chart below shows that long-term prices of grain are more stable than those of oil or gold.

Of the major commodities, oil has the highest price extremes while gold has the most volatile prices:

Smith also explained that the relative stability of grains over oil and metals is due to the fact that grains can be grown by anyone.

The drilling of oil and the prospecting for gold, in contrast, can only be done by people who have the required capital and expertise.

It might be useful to compare the real values of a particular commodity at different times and places.. In this case, we must compare, not so much the different quantities of silver for which it was commonly sold, as the different quantities of labour which those different quantities of silver could have purchased. But the current prices of labour at distant times and places can scarce ever be known with any degree of exactness. Those of corn are generally better known.. So we must content ourselves with them.

Adam Smith

The stability of long term wheat prices is the major reason why Smith advocated land (or at least land rent) to be valued in wheat. Since all economies rely on land, the stability or fairness in the valuation of land will, in turn, lead to more stability in all other commodities, helping to prevent the severity of bubbles and crashes.

Points are the Next Evolution After Cashless Economies

Nowadays, cash is being replaced by cashless systems.

Supereconomics begins the next evolutionary step by starting points-banking as the natural evolution of cashless systems.

This new system creates a whole new set of measures, transaction methods, and investment vehicles that fund productive labour directly and eliminate both inequality and employment:

- Clearing Funds as an alternative to Bonds

- Purchasing Power as an alterative to GDP

- Basic Universal Revenue as an alternative to money

- The Effort Theory of Value as an alternative to Marginal Pricing

Updates

| Date | Notes |

|---|---|

| Jan 11, 2021 | Harmonized with Pool Clearing |

| Dec 11, 2021 | Removed barter and instead focused on points, either as grains or gold |

| Mar 25, 2022 | Removed fiat |