Fourth Law -- Market Price

Table of Contents

The Fourth Law of Value states: Value is transferred through fair exchange whether it be through money, barter, points, promises, etc.

This law is derived from the Second Law of Thermodynamics which relates to heat transfer and entropy. This leads to the concept of Market Price which is the actual price nominal price that a thing is sold for in the market.

Unlike Economics which only has one market price for a product or service, Supereconomics allows variable market prices for the same thing, as an effect of Real Price Relativity or the relation between different kinds of people, since value is subjective.

In the real world, this is most commonly seen in Thailand where there is a higher “farang” price for foreigners and a lower natural price for locals. The mechanism there is the lack of fellow feeling with foreigners or those of a different mentality.

In the beginning, an economy might have gross inequalities (such as employers not caring about their employees and vice versa) and so have very different market prices (here the price is in wages). But as it is converted into a supereconomic system, the inequalities and disparities get balanced out through time, and market prices can be of a single form. At that point, the economy becomes united.

Barter-Credits

Inequalities in pricing can be minimized by using the points-based valuation mentioned in Chapter 3. The system can be run with very little money by using points and barter credits. For example, assume that in Town A, Arun has a vegetable garden and Bhaskar has a small bakery. Arun wants to buy 1 small cake worth $1. He has the following which he can offer:

| Items | Nominal Money Price | Real Value per unit of kilo |

|---|---|---|

| Dollars | $1 | 1 point |

| Tomatoes | $2 per kilo | 2 points |

| String Beans | $1.5 per kilo | 1.5 points |

Since the cake is 1 point, then he can make the following offers to Bhaskar: $1, 0.5 kilos of Tomatoes, or 0.6 kilos of String Beans. These all have the same real price of 1 point relative to both Arun and Bhaskar.

Of course, Bhaskar would readily choose the $1 since it is legal tender and can purchase other things that are for sale. We can regard this flexibility of money as a premium that adds to its real exchangeable value. However, he might choose to get tomatoes since that includes free delivery which can also be seen as a premium. The determining factor is the effective demand of Bhaskar, which is totally subjective.

| Trader (Value) | Nominal Price | Real Price (Value) | Market Price (Value) |

|---|---|---|---|

| Arun’s Tomato | $1 | 1 point (cake) | $1 (1 point) |

| Bhaskar’s Cake | $1 | 1 point (0.5 kg tomato) | $1 (1 point) |

Assume that Bhaskar opts for 0.5 kilos of tomatoes as payment for 1 cake. At that point, 0.5 kilos of tomatoes becomes the market value, while 1 point is the market price.

Points-Banking

The main advantage of this system is that it allows the economy to keep on running even if there is no money, as what happens during financial crises and recessions. If Arun only has 100 grams of tomatoes to pay for Bhaskar’s cake, Bhaskar can accept it and wait for the 400 grams next time, as a barter-credit.

This is opposed to giving only 20% of the cake for the 100 grams of tomatoes (which is direct barter, instead of barter-credit). The 400 grams of tomato-debt does not incur interest fees because the real value of a tomato is the same to the person who values tomatoes. This is also consistent with points not having the time value of money, as mentioned in Chapter 3.

Assume that Arun has no money but really likes Bhaskar’s cakes. So he commits to buy his cakes whole year round in exchange for tomatoes as 1 kilo per week or 52 kilos in a year. However, Bhaskar might not want so many tomatoes and is willing to accept only 22 kilos, as he really needs sugar for his cakes. What will happen to the unwanted 30 kilos?

A third party, called a points-banker, can take the 30 kilos and trade it to Chandra who has sugar and wants tomatoes. The sugar can then be given to Bhaskar as a roundabout trade. In effect, the barter-credit of Bhaskar was transferred to Chandra in exchange for sugar.The points-banker then gets a cut of the sugar and tomatoes for his services. We have tested this system with small transactions from 2017 up to 2024 in Hanoi, Saigon, and Manila as Pantrypoints (https://pantrypoints.com ).

Pool Clearing

This can be scaled globally by spreading the usufruct system overseas in a system called Pool Clearing, originally proposed by economist EF Schumacher as an alternative to Bretton Woods. This creates a pool of countries that trade with each other using both money and barter-credits, with money transactions going through a clearing fund, and barter transactions going through points-banks. This will end trade wars, and consequently real wars by making them illogical.

In Pool Clearing, nations trade with each other to help poor nations industrialize and to keep wealthy nations productive. This will end trade wars, and consequently real wars by making them illogical. In Pool Clearing, nations trade with each other to help poor nations industrialize and to keep wealthy nations productive. This is the opposite of imbalanced globalization where China has over-strength in production, Vietnam in agriculture, and the Philippines in services.

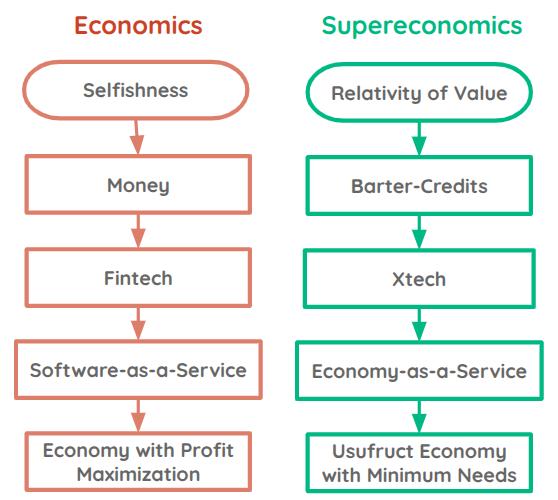

Xtech and Economy-as-a-Service

Lastly, Minimum Needs, Points-banking, and Pool Clearing can be integrated and globally as an Economy-as-a-Service (EaaS) in order to end crises permanently. This manifests as online apps and offline paper cards that facilitate points exchange, which we call Xtech or Exchange Technology, as a complement to Fintech.

These connect to each other through data hubs called APIs that can give supereconomic data in real-time to aid policymakers in adjusting regulations, monied-people to find more investment opportunities, workers for job search, and buyers for bargains.

Violations of the Fourth Law

The violations of the Fourth Law lead to the following economic problems usually involving money supply and circulation:

- Monetary Policy causing either inflation or recession

- The Great Depression from inflexible monetary policy

- Investment frauds such as ponzi schemes and cryptobubbles

- Hot money, attacks on currency

- Trade war and currency devaluations

- Debt slavery from interest and fees piling up

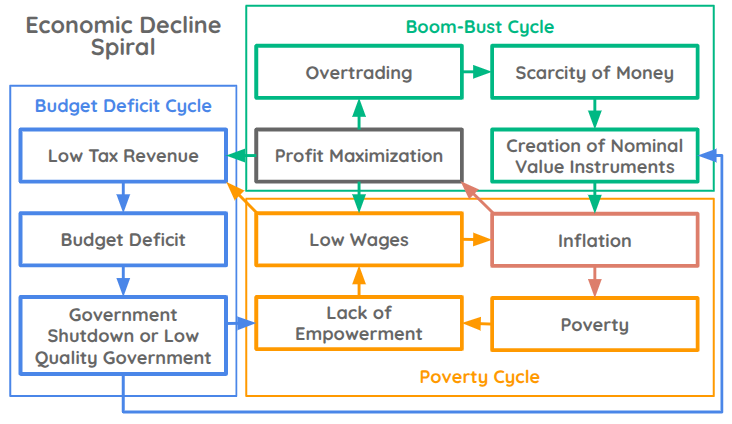

The Profit Maximization Doctrine of Neoclassical Economics is the heart of modern economic problems that commonly creates:

- the Boom-Bust Cycle for investors and businesses

- the Poverty Cycle for the working class

- the Budget Deficit Cycle for governments

This leads to a spiral of decline for any economy that adopts Neoclassical Economics. These cycles allowed us to predict the 2020 global stagflation in 2012, as well as a future 2028-2029 global economic crisis and conflict in December 2024 after the election of Donald Trump.