How the Effort Theory of Value Naturally Creates a Revenue Limit

Table of Contents

In a previous post, we explained how the Effort Theory of Value from Adam Smith unifies one’s personal interests and actions in order to maximize the value that he or she creates for others. The produce of this effort is a product or service that is commonly sold to others for money.

Points-based Barter: Naturally Expansive

Our proposed economic system adds an innovation to allow them to be bartered for the goods and services of other people to be delivered or rendered at a future date. This is different from the common conception of barter where both parties must have goods in hand to trade immediately.*

*Here, we tap into the Spacetime Layer or Vayu Element in the 5 Elements model

Before that future date arrives, the value is held in points which are pegged to a kilogram of rice or wheat in order to insulate the value from inflation. This makes the system expansive, letting people offer goods and services in exchange for the future goods and services of other people.

We call this a food-based valuation system.

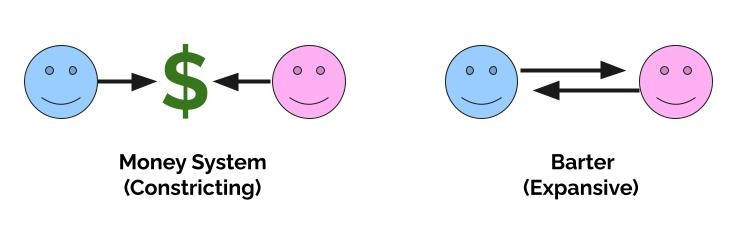

This is the opposite of the money-based system where goods and services are immediately exchanged for money which can then be readily exchanged for other goods and services.

This gives money a sort of premium over the goods and services that it circulates. This then causes people to desire money and hoard it – a constricting effect on the economy. This constriction manifests as crashes and recessions after a boom or growth.

Food-Based Valuation Versus Money-Valuation

Adam Smith says that a consequence of food-based valuation was the tendency to cause people to overwork themselves.

Almost all craftsmen suffer from some infirmity by overwork.

Ramazzini, an eminent Italian physician, has written a book about such diseases.

Our soldiers are not the most industrious people. Yet when they are liberally paid by the piece, their officers were frequently obliged to stipulate that they should not be allowed to earn above a certain rate every day.

Before this stipulation, soldiers frequently overworked and hurt their health by mutual emulation and the desire of greater gain. Wealth of Nations Book 1 Chapter 8

Adam Smith

In a money system, however, money can be gained by gambling. This is why the increase in adoption of the paper-money system caused a corresponding increase in risky activities, notably in the 18th and 19th centuries, such as:

- speculation

- ponzi schemes

- stock bubbles

- leveraging

In a barter system, however, there is no scope for gambling. A barter trade cannot be leveraged because the food-based valuation prevents it even if risk is transferred to the future just like the money system.

Easier to Implement Maximum Wages

Such features of the food-based barter system makes it more logical and natural to adopt maximum wage limits.

In the money system, having maximum wages are oppressive – imposing a limit is a negative action. Why should anyone limit the amount of material pleasures that a person can buy by limiting his money revenues?

In a barter system, on the other hand, people will readily accept barter-revenue limits once they realize the increase of their stress relative to the revenue from barter.

We can call this the diminishing returns of effort.*

*Effort here refers to the Effort Theory of Value

In this case, the limit is a positive action to preserve health and make business sustainable.