The Circular Flow of Economics vs Superphysics

October 17, 2019 5 minutes • 895 words

Table of contents

To maximize profits, business-systems pool money together in order to create the equity that makes up the firms and corporations. Such organizations then create, buy, and sell real goods and services via secondary arbitrage*.

*The difference between market prices

In time, these become very good at accumulating capital and starving others of it, causing a recession or crisis. Notice how ‘businesses’ is a huge entity in the Circular Flow of Economics below.

- To prevent inequality in Economics, taxation is imposed as fiscal policy

- To prevent the starvation of capital, monetary easing is intiated as monetary policy

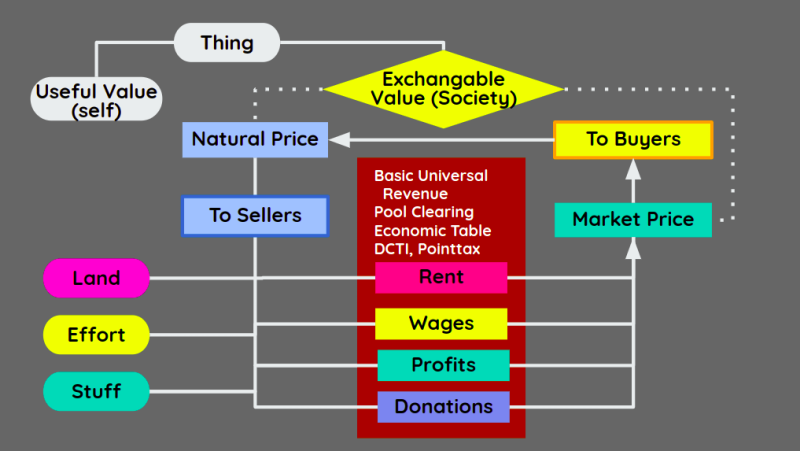

The Circular Flow of Superphysics, on the other hand, ensures the proper balance of capital by checking the two types of arbitrage through five tools:

- Basic Universal Revenue will check primary arbitrage in the local level

- Pool Clearing will check primary arbitrage in the international level

- The Economic Table of the Physiocrats will check the secondary arbitrage internally

- The Value Trade Theory will check the secondary arbitrage externally

- Social Fair tax will check both primary and secondary arbitrage on the local level

The High Market Prices of Economics vs the Low Market Prices of Superphysics

The dominance of business, arbitrage, and profit maximization in Economics leads to one common observable thing in all Economic systems:high market prices. After money is invented, it is pooled into corporations which is used to:

- create economies of scale, and

- lobby laws and lawyers to create intellectual property laws and tax breaks.

Such laws then prevent competition that could hamper the egos of those oligarchs and corporations. The common justification is that by protecting their interests, employment is preserved and social order is maintained. This is so easily countered by the fact that people can employ themselves as entrepreneurs, and each other as partnerships. This is especially true after the invention of the internet.

An easy example is the high price of iPhones wherein Apple works hard to protect its intellectual property and brand through the (in)justice system. This gives it high profits as unnatural prices which then benefits its investors or a tiny segment of society. This is bad because:

- It sucks the capital of society into a single industry or product, starving the other industries. For example, the medical industry needs a lot of funding to develop drugs* that can save lives. Yet, these are not developed because those patients often have no paying capacity. * Update Dec 2020: This has become true with vaccines that could have been used to prevent Covid from being so bad as it is now

- The intellectually-protected technology cannot be applied for other uses, preventing innovation as if the technology never existed. It is true that Capitalism spurs innovation, but only for the profitable parts. In some cases, it actually creates negative innovation if you see a profitable tech company as sponge that sucks all the talent and creates a brain-drain for other sectors of science & technology

High Prices Lead to Bad Things

High market prices have led to povert, inequality, and revolution ever since money was invented. The high market prices of assets such as stocks and property have led to stock and real estate crashes which destroy value and savings, which then destroy the accumulated work done.

This regular destruction of wealth and low purchasing power of savings then implies that people are really just working everyday for food, rent, and utilities in order to keep on working for food, rent, and utilities – not so different from a slave.

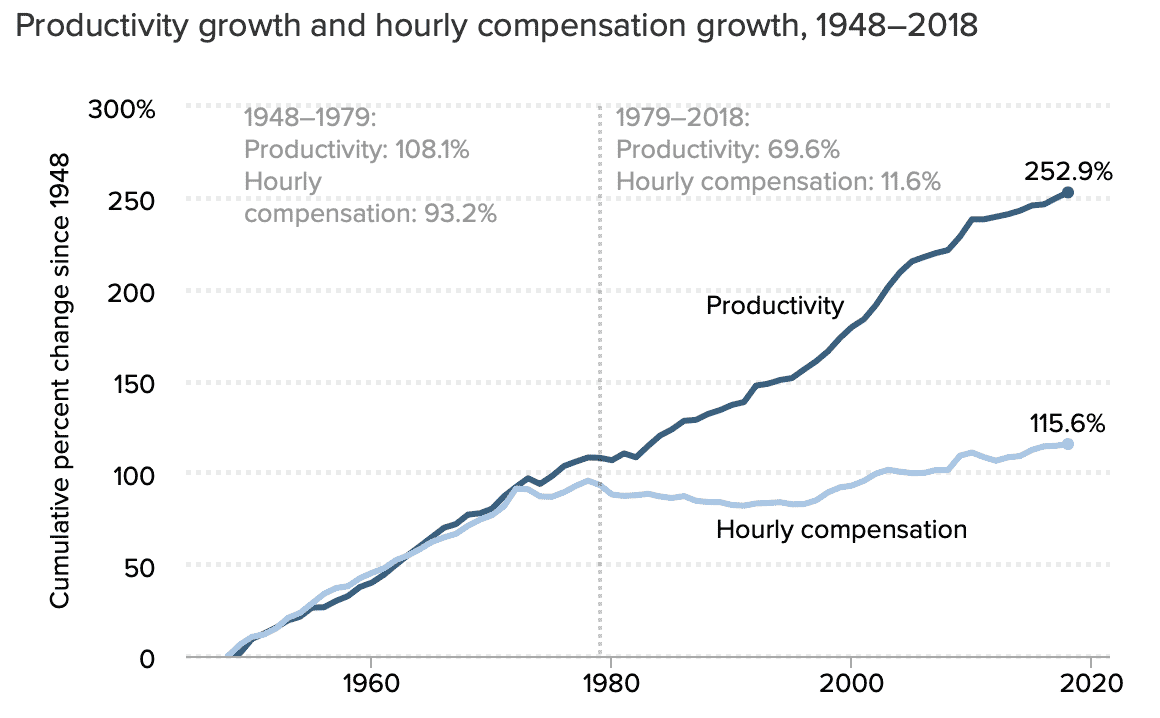

Slave wages have been a thing since the 1970’s. Objectively, it sucks to be a Gen Xer or a millennial who are economic slaves to baby boomers who have taken all the good parts of the economy for themselves and are “squatting” on the real value of society.

The Goal of Superphysics: Zero Inflation

All of these then lead us to create one of the main goals of Superphysics which is zero inflation. This is different from the goal of Economics which is an inflation of 2-4%.

To explain why a 2% inflation target is bad, we first have to define inflation and deflation in Part 2 and show why the 2% inflation target of Economics naturally leads to inequality by favoring the business class, at the expense of the working class.

These then explain why economic crises, poverty, and inequality still persist despite over 100 years of Economics –because its principles actually create crises, poverty, and inequality.