How to Fix Greece

Table of Contents

We can use our DSIT tool as black box for the 4 laws of value to analyze the Greek crisis to prove that austerity and high taxes are not the best solutions.

Such technocratic solutions are are a relic of the mercantile way of thinking of an economy as a business, instead of as a society.*

Update Nov 2016

The 2008 Credit Crunch triggered the crisis, so we set:

- 2009 as the central-point

- 2013 as the last point of our Value-Trade analysis

- 2001 as our starting point

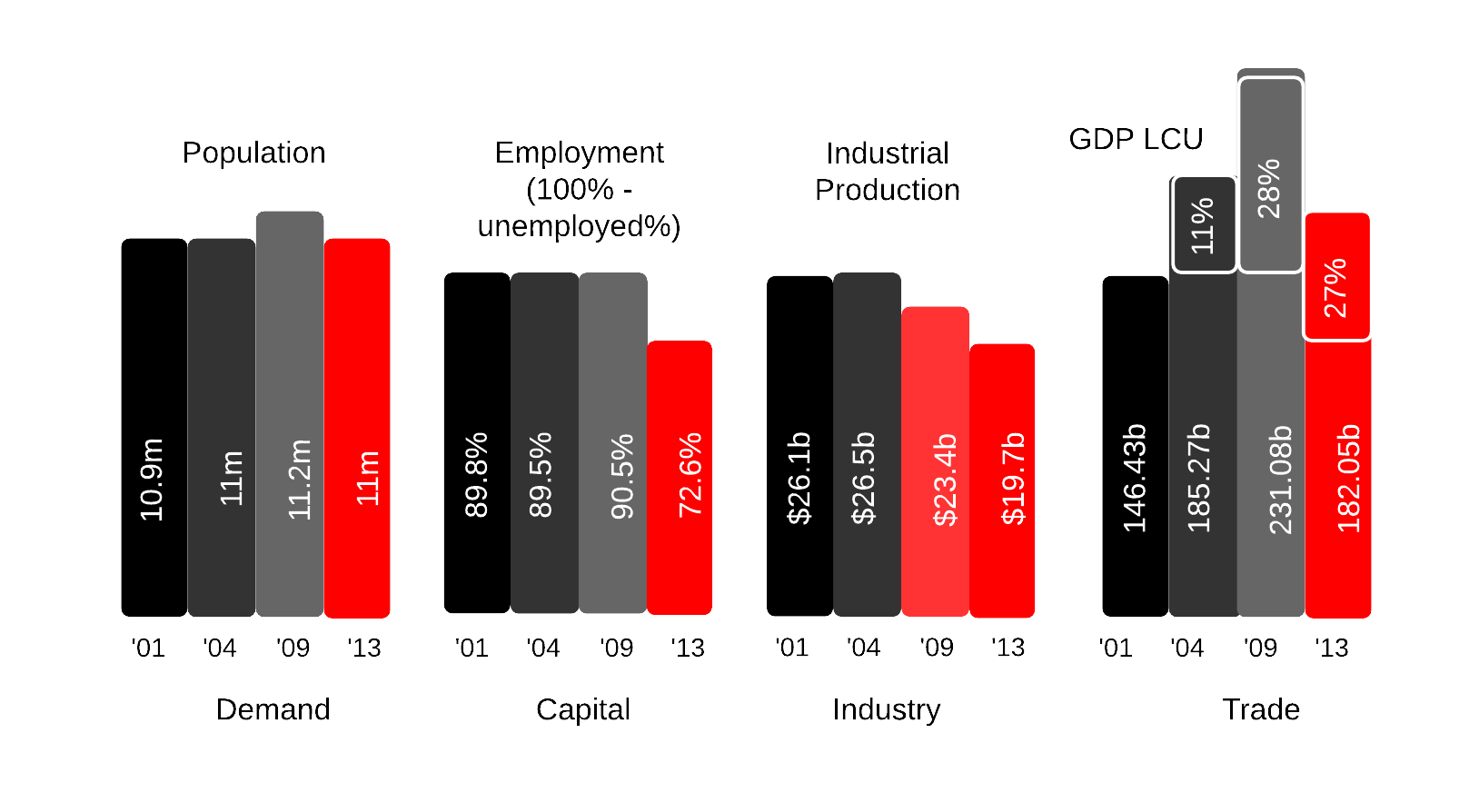

Greece 2013: High Demand, Low Trade

| Metric | Notes |

|---|---|

| Demand | The Population from 2001 to 2009 is ok. But the decline in 2013 shows an anomalous reduction |

| Supply | Employment from 2001 to 2009 is also ok, so that is not the cause of the problem |

| Industry | Production started to decline by 2009. This is strange because its employment was good |

| Trade | Trade rose from 2001 to 2009. This is strange because it is way above its supporting capital |

We can pinpoint the anomaly to the strange increase in trade in 2004 and 2009 that did not contribute to industry. This means that the trade was speculative (like in a stock market crash) or unproductive (like in a debt crisis).

As there have been no reports of a crash or a great scam in Greece, it means that the cause was a debt which was used unproductively.

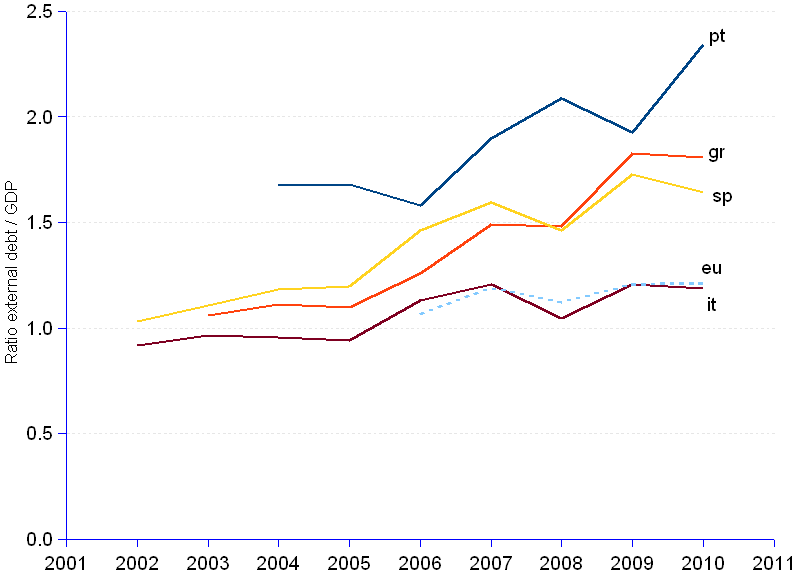

A lot of European countries, such as Spain, Portugal and Ireland, also had debt and almost had a crisis like Greece.

So why did Greece suffer a debt crisis?

A Consequence of the Derivatives Spree in the 2000s

In the 2000s, credit default swaps took off.

It allowed large corporations to take on huge amounts of debt and spread the risk to so many people and investors.

The key change was to regard the derivatives as an insurance product which could be sold to many people, instead of as a loan.

Previously, this was illegal.

But the repeal of Glass-Steagall suddenly allowed it from 1999.

This allowed banks to sell huge amounts of debt which then gave huge amounts of profits, and so they pushed it aggressively.

It soon spread to public debt where governments were offered so much debt.

This is why former Greek Prime Minister Simitis blamed “European economic management”.

This is why both private and public debt ballooned and collapsed nearly at the same years:

- from 2007, as seen in the fall of Lehman

- to 2010, as seen with the fall of Greece

This is very similar to the Latin American debt crisis wherein petrodollars needed to be used. And so they were lent to dicatators.

The evils of debt were very well known in the 18th century, especially to Adam Smith who blamed the finance industry for it:

Such improvident anticipations gave birth to the more ruinous practice of perpetual funding. This practice puts off the liberation of the public revenue from a fixed period to an indefinite period, never likely to come. However, it raises more money than the old practice of anticipation. When men became familiar with funding, it became universally preferred to anticipation during great state exigencies. Relieving the present exigency is always the object of government. The future liberation of the public revenue they leave to the care of posterity.

Adam Smith

The Wealth of Nations Simplified, Book 5

Large Debt = Wasteful Spending

Unlike Spain, Portugal, and Ireland, Greece had more opportunities to waste huge amounts of debt in the following ways:

- The Athens Olympics

- Military spending

- Socialist government pensions and salaries from a governement

The Greek government’s solution was:

- austerity as decreasing services and pensions

- raising taxes

This resulted in the suffering of the people without the bankers getting punished proportionately.

The Solution: Barter and Multilateral Clearing

If gold and silver should fall short in a country which can buy them, there would be more expedients for supplying them than almost any other commodity. If the materials of manufacture are wanted, industry must stop. If provisions are wanted, the people must starve. But if metal money is wanted, barter will supply its place, though with much inconvenience.

Adam Smith

Wealth of Nations Simplified, Book 4, Chapter 1

Adam Smith’s solution to financial crises was to revert to barter and to pay for the debt in kind.

Moneyless Economy

Instead of Greece raising money-taxes, it will tax in kind.

- Companies will pay their taxes in their own products

- These export-quality products will be exported to the creditor countries

- The non export quality products will be used for government puposes such as pensions-in-kind or government salaries-in-kind

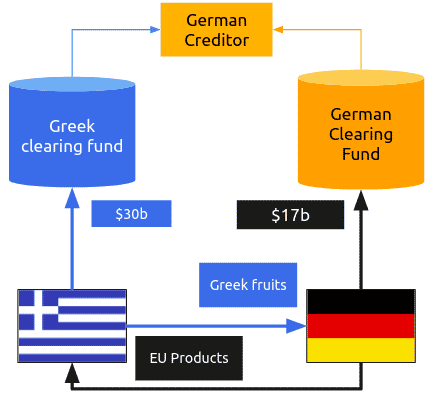

The EU can set up a clearing office in the countries that Greece owes money to. This leads to:

- a clearing office in France

- a clearing office in Germany

Greece will then send Greek products (from taxation) to those clearing offices to pay for its debt.

The French/German clearing office will sell the Greek products for euros which it will then give to the French/German creditor banks.

France and Germany can then encourage their people to buy more Greek items in order to give liquidity to their own banking systems.

Unlike the financial solution which kills the economy to pay for the debt, the moneyless solution spurs the economy.

In effect, the clearing funds unify the EU states into a barter union to offset the problems of their monetary union.

This keeps individual member states independent and able to state their own fiscal policies without needing a fiscal union*.

*A fiscal union is a mercantile solution similar to a corporation buying its suppliers and customer-companies in order to vertically integrate for greater efficiency. It would be a sort of imperialism among nations.

Multilateral Clearing for Services

As Greece is a country known tourism and hospitality rather than industrial products, we can extend multilateral clearing to Greek services to pay off the debt faster.

- EU citizens can deposit Euros into their nation’s clearing office

- They can use their deposit to book hotels and prepay services in Greece

- Those hotels offer rooms and packages as tax payment

- Part of the payment will go directly to the creditor bank

- The EU can encourage its citizens to avail of Greek tourism and deposit into the fund to pay off the debt faster

To further raise tourism revenue and make it regular, the EU could make Greece a permanent Olypmics or sporting competition site for Europe so that the spending for the 2004 Olympics would not go to waste. This would make sense since Greece was the original birthplace of both ancient (Olympia) and modern olympics (Athens, 1859).

This system can be scaled to other countries so that the monopoly of finance can be broken and economic crises can be avoided. This proposal from Adam Smith was refined by EF Schumacher, not only as an economic solution, but also as a deterrent to war.

Updates

| Date | Update |

|---|---|

| Mar 2024 | Added credit derivatives, and EU weakness, as the main cause of the fault |

| Oct 2025 | Overhauled to meet the 4 laws of value |