Basic Points Revenue

August 20, 2020 10 minutes • 2012 words

Table of contents

Universal Basic Income (UBI) became popular in 2016 after it was adopted by a few Western countries.

In UBI, money is given to poor people without any strings attached. This makes it a bit different from Conditional Cash Transfers (CCT) which imposes conditions that the poor must meet.

What’s Wrong with Universal Basic Income?

In general, studies have found 2 flaws in UBI:

- It contributes little to alleviate poverty as a whole

- It is expensive to administer

Adam Smith, the founder of Economics, would be against UBI because:

- It can only be measured in nominal value

- It acts as an expense instead of as a capital – there is no guarantee that the recipient will use it for education to build up his knowledge, or to buy healthy food to build up his body

In mercantile and manufacturing towns, the poor are chiefly maintained by the employment of capital. They are generally industrious, sober, and thriving.. It is better, says the proverb, to play for nothing than to work for nothing.

Development banks want UBI for them to find use for their idle money which is of no value when not circulating. Therefore, UBI is an easy sign that the profits in lending are very low, that banks have to find radically new business models.

Governments of democratic countries like Brazil and the Philippines want it because it lets them placate the poor and prevent public disobedience or the rise of Communism or terrorism. Unofficially, it helps politicians buy votes*. The abandonment of UBI in Finland and Bolsa Familia in Brazil are proofs that UBI is not sustainable.

*This is proven by presidential candidates using dole outs during their election campaigns

Microfinance is Better

Smith would rather be in favor of microfinance which are small loans, usually given to poor people to start a micro-business or cooperative.

- The loans would then be used to provide wages, reducing unemployment

- The wages would then be used to pay for the education of children

Loans are supposed to serve as one’s capital, and thus, are not supposed to be spent recklessly as an expense. A capital pays for itself, but an expense does not.

Problems with Microfinance

This solution would not work if there are many regulations against self-made goods or services. Assuming that the law allows solo and cooperative enterprise, then microfinance would have 2 general problems, one with supply and another with demand:

-

The demanders of loans are poor people who are deficient in practical skills like saving, diligence, hardwork, grit, problem solving, etc, otherwise they would not be poor in the first place. This could be caused by childhood development problems, bad environment, oppressive family or community members, and so on.

-

The banks might be predatory or inefficient especially in poor countries where the morals are low, law enforcement is not strict, or infrastructure is undeveloped.

Pros and Cons

Microfinance, UBI, CCT thus have pros and cons:

| _ | UBI | CCT | Microfinance |

|---|---|---|---|

| Pros | It mobilizes productivity liberally by feeding it cash | It prevents this mobilization from being unproductive by imposing conditions | Its conditions are simpler – the debtor just needs to repay regularly |

| Cons | It has no control to prevent this moblization from being unproductive | Its conditions require administration which requires a big expense | Few people are eligible |

Pointization Solution

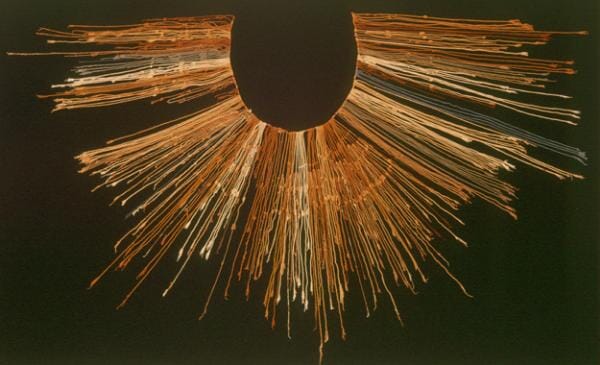

Supereconomics introduces the concept of pointization or the conversion of economic value into points which are pegged to grains. These points are created whenever there is an agreement by two parties.

For example, John can give his harvest of 1 kilogram of potatoes to Martha in exchange for 2 points (assuming that 1 kilogram of potatoes is worth 2 kilograms of wheat).

- John will then have a right to claim those 2 points as whatever Martha is producing.

- If she is a baker, then John can claim bread worth 2 points from her in the future.

Thus, the points are not created by any bank, but by the people themselves judging the value of the goods and services of others relative to themselves and others.

The points can only be created and destroyed as deposits and claims, similar to tags in a baggage counter. As such, the points are not exchangeable and are not legal tender.

So far, only the “take tags” * of the Resource Based Economy (RBE) has a similar yet rudimentary idea of this.

*These are different from a gift economy and a time-banking system.The flaw in RBE is that they have no background on metaphysics . This makes them focus on physical resources, different from Supereconomics which is based on fellow-feeling

This service provides the following advantages:

-

Like UBI, it mobilizes productivity by letting people feed each other with points

-

Like CCT, it imposes conditions between people based on their agreements

-

Like Microfinance, the points can be claimed regularly to see which point-producers are actually productive and reliable

Points Bailout

During economic crises, the points can be used as interest-free deposits of goods and services to distressed companies. Those deposits can be paid back with the future productivity of those companies.

For example, a soon-to-be bankrupt airline can stay afloat by getting a deposit of fuel and parts that it needs to maintain its fleet.

- In return, it gives flier miles to its creditors for the value of those resources.

- Instead of an interest rate, a direct markup is assigned.

When viewed on a macro level, the points-deposits represent an estimate of future productivity.

This is different from money-deposits which represent actual productivity. Money-deposits are governed by interest rates as the ’time value of money’, but points-deposits are governed by the moral sentiments* of the exchangers.

*This is why The Theory of Moral Sentiments is needed before The Wealth of Nations

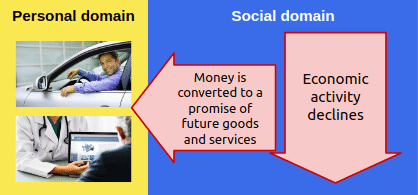

- ‘Monetization’ speeds up an economy by converting goods and services into money through sales

- ‘Pointization’ is the opposite conversion of money into a promise of future resources.

Pointization thus saves companies and societies from a monetary crash, by facilitating a soft-landing.

Basic Points Revenue

The points are very useful during crises. During personal crises, the points manifest as ‘Basic Points Revenue’ or BPR. It will convert anyone’s productivity into points which can be exchanged for food or other basic needs to get through a crisis.

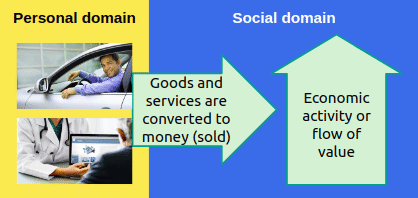

This is similar to how the Inca established a nonmonetary economy using strings called quipu that represented an amount of food in the granary.

A donor can jumpstart the economy by giving food to the poor in exchange for points which the donor can claim through the labor or produce of the poor. For example, if the donor is the government, then:

- it can provide food for the relief of the poor

- The poor will then give back the points by being street sweepers or agricultural workers for the government when at their leisure.

In this way, BPR can create full employment witout being a debt-trap like microfinance, nor encourage idleness as what happens with UBI. It can also be administered fully online, making it cheaper to run.

A Proper Store of Value is Needed, Not Another Currency

A shallow person would likely run with this idea and create a grain-based cryptocurrency that would be convertible to a real commodity.

However, this would merely allow the hoarding of that currency just as fiat is hoarded in the current system. Such a grain-currency would merely end up creating the same poverty and inequality.

| Type | Universal Basic Income (UBI) | Basic Universal Revenue (BPR) |

|---|---|---|

| Source | Free Money | Goods Deposited by People |

| Inflation Risk | Inflationary | No Risk of Inflation |

| Real Purpose | Give money to poor people so they can get the economy going (effect) | Give rewards to productive labor so they can increase the productivity of society (cause) |

Example 1

A bakery can make basic bread costing $1 each.

- Unemployed people can go to the bakery and claim one, giving 1 point to the bakery for each bread claimed.

- The bakery can then claim oven-fuel (such as gas) from the government in exchange for the points.

- The bakery can thus claim $1,000 worth of fuel if it gives out 1,000 bread, which it can use to bake for-profit bread to earn money.

In effect:

- the bakery barters its bread for gas

- the government barters its gas for social welfare

Example 2

A community pantry accepts plastic waste or compost collected by poor citizens in exchange for points.

- They can exchange the points for vegetables in the pantry.

- The waste is given then given to recyclers or urban farms who give money and vegetables to the pantry to maintain the system.

- In effect, the citizens barter their labor for vegetables through the pantry

A Stepping Stone to Pool Clearing and Points Banking

But what happens when a human moves from Country A to Country B? What happens to all his points left in his country? Can these be moved with him?

BPR prevents arbitrary productivity-transfer in order to not let productivity get sucked away or be amassed by other people. This prevents inequality and would have prevented:

- the Asian Financial Crisis

- 2008 Financial Crisis

- the speculative attacks by George Soros

- the 2008 Food Crisis.

But does this mean that foreign investments can never be made?

To answer this, we need to remember that BPR is only for basic needs such as food and healthcare (and possibly utilities). Its goal is to render as many people (and animals) productive so that they can eventually produce goods and services that go beyond the basics.

As the people gain more productivity, they will naturally go outside of BPR and back into currency to buy more sophisticated goods and services.

If a person with a huge amount of BPR points in Poor Country P moves to a Rich Country R, then his points will have to be converted by an intra-national clearing system that converts the points to their proper productivity values.

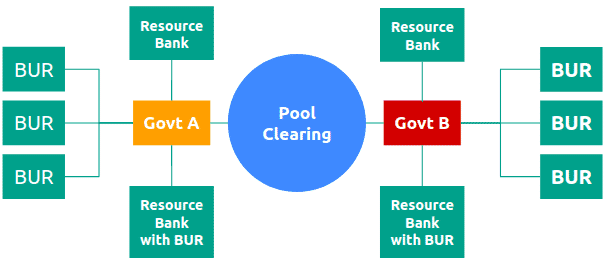

Such a system, called Pool Clearing

*, will connect certain hubs in Poor Country P to certain hubs in Rich Country R. Only those hubs that are connected can transfer the points. To offset the cost of converting the points, those hubs, which we shall call “International Point Banks”, will offer a worse price than standalone hubs.

*The idea for a clearing system that connects the resource banks is derived from the pool clearing proposal by EF Schumacher in 1943. The difference is that his system is ’top-down’ and uses local currencies, whereas BPR is ‘bottom-up’. In addition, our BPR-Pool system directly implements Adam Smith’s free trade system that can work with or without money, which it replaces with points. This makes it even more resilient than the version proposed by EF Schumacher.

For example, the bakery owner closes his business in P to move to R.

- If he has 1,000 points, then these will be converted to 900 points in

Rto help him have fuel to start his business. - The 100 points lost is credited to the Point Bank who transfers his data and checks with the local government in both countries.

Pool Clearing thus allows BPR to spread globally so that poverty, inequality, recessions and economic crises can likewise be prevented globally.